Inevitable features that you should look in STO Exchanges

The blockchain is transforming the finance. The traditional trading that has been in use since 1980s is quite sluggish and lacks transparency. The good news is that digital assets or tokens are reinventing traditional exchanges and revolutionize security trading. It aids billions of unbanked individuals to leverage best out of new global crypto-economy.

With $256 trillion of real-world assets globally, the potential for crypto-securities is really huge. On the basis of the current curve of security tokens, they could be a common slice of Wall Street parlance in the upcoming future. It can be much stress-free to simplify trading on a large scale as Bitcoin, and other crypto coins are not categorized as securities.

Security tokens are more complicated as it necessitates not only trading abilities but require issuance and critically compliance as well. However, regular exchanges are shifting to facilitate tokens trading. There are a plethora of features you should look for in STO exchanges. Let’s move into it.

Blockchain & Wall Street 2.0

Digital assets are revamping outdated financial and social configurations. They are linking billions of unbanked persons with a new economy. This cutting-edge technology combines the P2P method of computing established in Silicon Valley with the old money-management procedures of Wall Street.

Security Tokens and STO lay the substance for the Wall Street 2.0 transformation. They leverage the best out of blockchain technology and spread over securities. It will aid with transparency, immutability, P2P transaction, quick settlements, decreased costs, individual control over an asset and much more. Digital securities pretend infinite possibilities for the financial investments.

“For the last two years it has been exciting to continuously innovate and disrupt a financial market ecosystem that is ripe for improvement. With this first ever regulated security token, we are entering a new world of capital formation that I believe will become Wall Street 2.0.”

tZERO CEO Joe Cammarata stated.

Crypto-Hedge Fund

While making plans for the future, generally everyone advice is to invest in mutual funds as it is quite attractive for everyone. They differentiate your portfolio as the fund is united into one that purchases a variety of stocks/bonds as well as other securities. To hire a manager for this hard work is another excuse. Hedge funds offer related benefit, and only the advantages are massive. So if you have a question that why no one has endorsing hedge funds as an option of investment, it’s because it is for those super wealthy.

Hedge funds had a huge influence on Bitcoin and cryptocurrency world over the previous months. It is not at all surprising to consider the trend in which the digital coins sector has developed. There are plenty of organizations categorized as hedge funds. They have a fair volume of digital assets under their control. You can find some exciting names on Diar Weekly’s list of top crypto hedge funds.

“I expect the crypto markets to remain volatile for the foreseeable future. Whilst retail investors may see volatility in the crypto markets as a downside, many crypto funds see it as an opportunity.”

said Henri Arslanian, cryptocurrency lead for Asia at PwC.

He added that the “long term positive impact of the number of institutional players entering” is more significant than short-term price variations.

Cryptocurrency Hedge Funds Were Down 12% to 19% in May 2018

The Current State of Crypto Hedge Funds

Crypto-Dividend Distribution

Dividends can be delivered as cash payments/shares of stock/other property. And when different cryptocurrency organizations perform the same conception of earnings sharing, it is called as crypto dividends. This is not the same as airdrops because airdrops are ultimately the reduction of total supply that effects in the reduction of everyone’s holdings.

Different Methods to earn Crypto Dividends

These vary from currency to currency as each one has its own method for functioning and own rules-regulations.

- Staking- Holding a Proof-of-stake coin within a unique wallet.

- HOLDing– Buying & holding crypto in any wallet.

SEC Regulation

Everything seems to be shifting, ever since the SEC stepped in. The SEC’s basic operation is to supervise companies and persons in the securities markets, comprising securities trading platforms, brokerage companies, traders, investment consultants and different investment funds. With proven securities rules and regulations, the SEC endorses sharing of market-related statistics and facts, fair dealing as well as security against fraudulent activities. Investors will get accessibility to registration statements, episodic financial reports and other securities forms via its EDGAR database.

Different laws are at the SEC’s clearance for achieving its objects. They are:

- Securities Act of 1933

- Securities Exchange Act of 1934

- Trust Indenture Act of 1939

- Investment Company Act of 1940

- Investment Advisers Act of 1940

- Sarbanes-Oxley Act of 2002

- Dodd-Frank Wall Street Reform & Consumer Protection Act of 2010

- Jumpstart Our Business Startups (JOBS) Act of 2012

ATS compliant (Alternative Trading System)

In the widest sense, an ATP is basically a marketplace that connects numerous buyers and sellers of securities. This is a function traditionally executed by stock exchanges only. Without being regulated as exchanges, ATPs control automated systems as per the rules defined by the system’s operator – in a way that results in, an irreversible contract.

An ATP does not define any regulations and rules for participants. Usually, trades in any security were mainly performed on conventional exchanges. As ATPs flourish, securities buyers and sellers have an expanding range of options on deciding where and how to perform a trade.

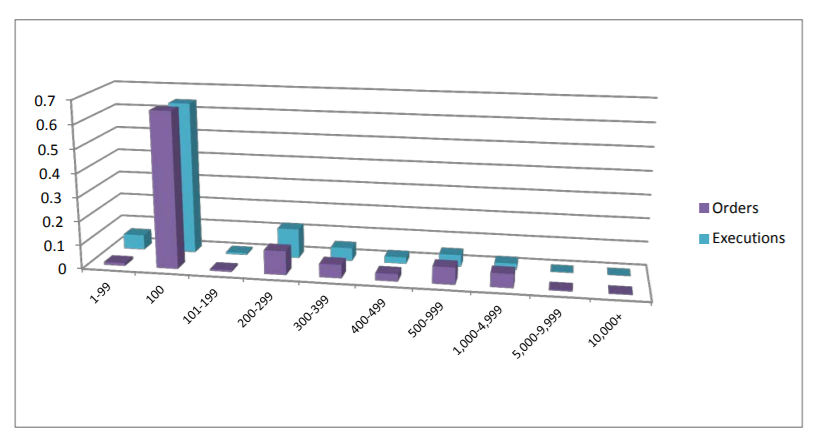

ATS Order and Fill Size Distribution, All ATS Venues:

Summing up

As the crypto economy develops, we are moving slowly closer to an innovative arena of real-world assets/tokens being securitized on the blockchain technology in a regulatory compliant way. The challenge for traditional as well as crypto exchanges is to inform investors about this cutting-edge technique of buying and selling investments while operating these securities transactions via a seamless experience. Eventually, security tokens lay the basis for enabling investors their biggest wish — the skill to trade real estate, equity, debt, and digital assets everything on the same platform.