A distributed matching engine for digital asset trading

A matching engine is a fundamental software behind a computer-driven crypto exchange. A crypto trading and almost other financial tools are now completely empowered by electronic matching engines and the software supporting this.

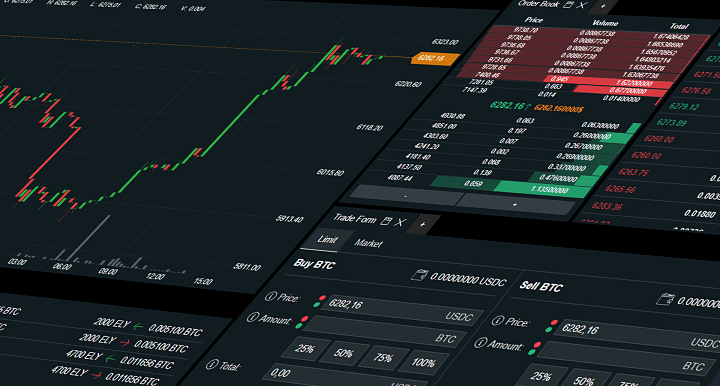

Distributed matching engines matching-up trades on the platform by assigning bids and provides a certain set of algorithms (rules) in this competitive edge. With an effective order allocation procedure, electronic matching engines perform to cut down transaction fees to currencies at the same time improve market quality (lesser spreads, better order book depth).

When it comes to relative & absolute terms, the rapidity one can obtain, understand and react to market detail is an important concern; for both traders and exchanges looking for a competitive benefit.

Enterprise Matching Engine

Enterprise matching engine offers high throughput. It also provides out-of-the-box Limit and market orders. The best enterprise matching engine should comprise,

- Ultra-lean design

- Advanced risk controls

- Order lifecycle management

- Advanced order routing

- Market risk settings

General Rules Relevant to Trading Platforms

A digital asset trading platform would be controlled on the basis of a nature of different crypto assets traded on the platform (i.e. pure crypto coins or tokenized securities), as well as the nature of a system.

There are plenty of market regulators who need securities trading system that empowers different buy and sell orders to act together and apply non-discretionary algorithmic approaches to match buy and sell orders to be regulated as a trading site.

E.g., in the EU, an exchange that trades securities, containing tokenized securities, use an automated matching engine. It would be regulated as a trading venue. It needs the trading venue to be authorized by the proficient authority in the home member state of the platform. It also necessitates compliance with in depth organizational, systems-related, as well as the conduct of business requirements. Furthermore, regulated trading venues are a matter to in depth transparency needs.

Digital Asset Trading

The Digital Asset exchanges have been the main factor when it comes to validating the value of blockchain and its future perspective. We are now seeing digital trends that are implementing a completely new relationship among blockchain organizations, their tokens as well as the crypto trading platforms. Although blockchain signifies decentralization in its nature, crypto exchanges in other hand have been centralized profiting token holders´ trading. Though it is significantly changing.

Blockchain and digital coins have compelled the existing financial system to the level where there is no back move. In this emerging arena of virtual currencies, trading has become easy, transparent as well as decentralized. The decentralization of the trading platforms is now accepting the ideas of sharing economy.

Salient features a next-generation order matching engine should comprise

- Seamless API integrations

- Order and quote management

- Real-time data

- Set of front ends

- Flexibility

- Multiple Algorithms

- Low latency

- Pre trade risk management

Summing up

Advanced order-matching algorithms are supported by an exclusive trade engine. Liquidity of order book enables to perform high-volume orders and implement market making as well as high-frequency trading and scalping approaches. Therefore, an advanced exchange is leading in a new age of standardization in crypto trading by emphasizing on adhering to security, usability and compliance.