Go Cashless by Integrating Top Payment Gateways into Your App

If you are planning to start an exciting business and want to make it a customer-centric brand, you would definitely face challenges while finding the best Payment Gateways to integrate into your mobile app.

On the other hand, if you are unhappy with the already integrated payment gateway into your app, and want to drive a change without compromising on quality and overall performance, then this post will definitely help you out with the same. Let’s initially understand what a payment gateway is.

Payment Gateway: What is that?

A payment Gateway is software that collects payment from the customers and transfers it to the recipient. A payment gateway validates customer’s card data securely, checks that money is there, and ultimately facilitates merchants to get the money.

These gateways are acting as an interface among merchant apps/websites and purchasers. It encrypts customer’s confidential card details by assuring that data passed with maximum security from customers to the bank through merchants.

What is the Role of a Payment Gateway?

Besides the key role of authenticating different transactions, a PG performs additional major tasks.

- With high security, it stores all the confidential details of customers for future transactions.

- Accept multiple methods for online payments.

- Streams different transactions in complete safety.

- Preserves a steady channel without any interruptions to send funds from the bank accounts of the cardholder to the receiver.

- Streamline the payment process to pay effortlessly.

How Do Payment Gateway Functions?

Customers will be transferred to a secure payment page while checking out. Various steps take place throughout the transaction process.

- A user/customer initiates a payment after submitting an order.

- Vendors transfer order information to Payment Gateways.

- Then a transaction is forwarded to the issuing bank or the 3D secure page to demand transaction authentication.

- After successful authentication, a transaction is approved or rejected by the bank or card (Visa, Master, Maestro, American Express) based on the availability of funds in the account.

- Payment Gateway notifies merchants of the same by sending an SMS accordingly.

- The bank then fixes the fund with Payment Gateway, and Payment Gateway fixes the fund to the vendors.

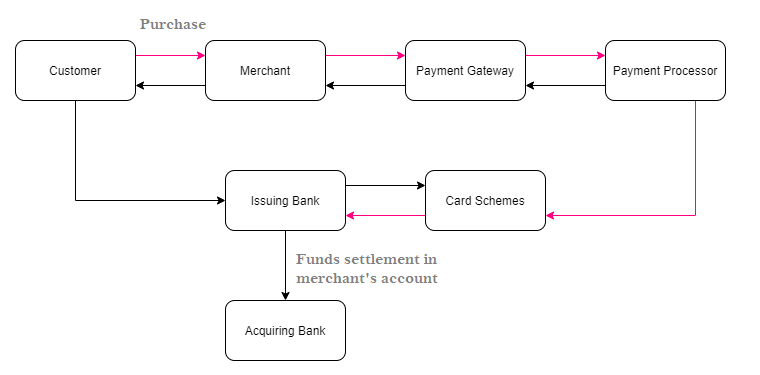

Payment Gateway Architecture

There are plenty of payment systems but they all function in almost similar ways. Have a look at the PG Architecture.

Mobile app payment gateways

Before presenting the list of payment gateway, we want to assure that we are not favoring any particular Gateway. We aspire to do all the groundwork and provide everything as per our findings.

1. Paypal – Features

- Accept Credit/Debit cards

- Multiple currency support

- Instant Payment

- Dispute resolution

- Dashboards/reports

- Levels 1 and 2

2. Stripe – Features

- Accept Credit/Debit cards

- High performance and reliability

- APIs

- ACH payments and eCheck processing

- Payout time

- Dispute resolution

3. Braintree – Features

- Fraud detection

- Data security

- Multiple payment methods

- Reporting

- Payouts

- In-store payments

4. Apple pay – Features

- POS verifications

- Two-factor authentication

- Data tokenization

- Omnichannel

- Coupons, discounts, promotions, and gift cards

- Online payment portal

5. Go cardless – Features

- Account integrations

- E-commerce integrations

- Online payment portal

- Processing fees

- Reports and analysis

6. 2Checkout – Features

- The Global Payments

- Digital Commerce

- Subscription Billing

- The Global Tax & Financial Services

- Risk Management & Compliance

- Partner Sales

7. Authorize.Net – Features

- Accept Credit/Debit cards

- PCI regulation compliance

- Data tokenization

- Fields, objects, and layouts customization

- Accounting software integration

- Split Payments

8. Bolt – Features

- Blacklisting

- Bot mitigation

- Fraud detection

- Alerts

- Transaction scoring

- Intelligence reporting

Payment Gateway Integration in Android and iOS apps

Integration of payment gateways can be performed mostly by following these two methods.

- Implement payment process straight to the mobile app while asking users to add debit/credit card details.

- Users will be redirected to the intermediary service provider who accepts payments. Then you’ll get an encrypted payment detail that assures payment paid fully from the user side.

You need to assure that all the financial transactions are performed by following PCI standards to protect the card holder’s confidential details. Along with that, every payment gateway service provider has prepared SDKs and detailed documentation on how to integrate PG with a mobile app that will guide the developers.

Check out this video for a better understanding.

Summing Up

In some form or another, organizations have to make their brand advanced to keep pace with the customers’ demands. Whether it is any startup or a well-grown business, entrepreneurs need to ensure that there must be a setup for an online payment system on the business Website or App. It is always best to leverage an exemplary payment gateway that makes it easy for customers to pay online.

Source: https://bit.ly/3cm8tJK