Security Tokens Offerings Exchange – Extremely Potential or Short Lived?

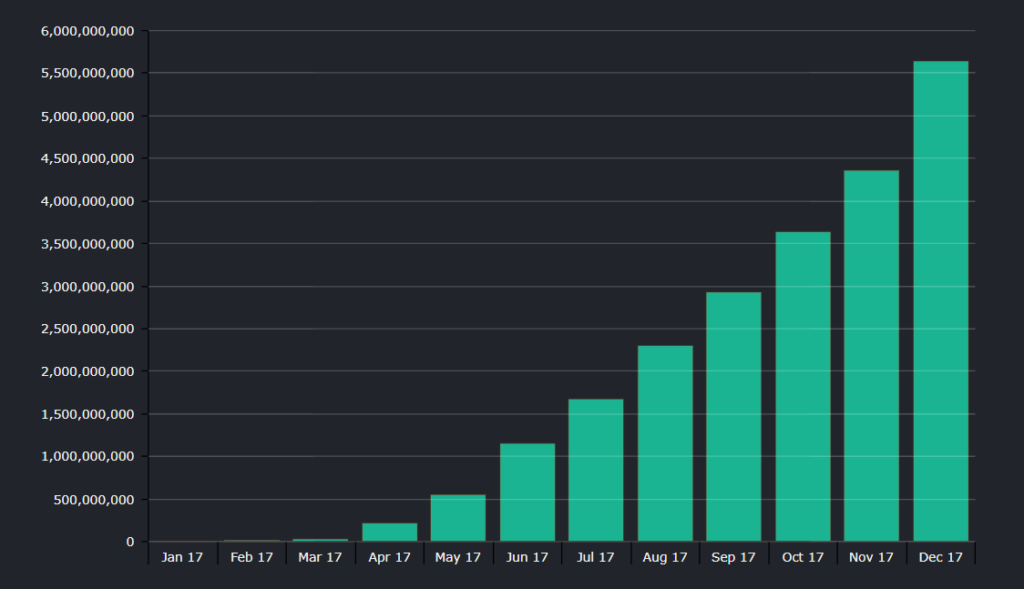

Since five years of first ever ICO launch, it has raised more than $3.7 billion until December 2017. The year 2017 represents the upsurge of the funds raised with this new funding method. This chart showcases the cumulative growth of ICO. $5,642,588,112 is the overall extent of money raised from ICOs in 2017.

The traditional stock market was designed to be more/less predictable. There are no limits on the number of stocks of a specific organization. An additional portion of stocks can be issued at any time. It assures steadiness when supply as well as demand ratio shifts. On the opposing, utmost cryptocurrencies have a hard cap. i.e. Bitcoin is restricted to 21 million tokens, and this insufficiency drives the value up as the currency moves closer to mass-adoption. This kind of gap flanked by traditional and cryptocurrency markets removed by Security tokens.

In the base of this new paradigm of fundraising is the token and the tokenization of digital/physical assets. The security token signifies a tradable element of real-world value as well as offer a blockchain-assured transaction record. Blockhain connects multiple parties in the network of trust and reliability. It facilitates the transfer of assets as well as the detail regarding the assets.

Clearer rules and a regulatory framework are needed for Blockchain businesses for the securities which already exists. By getting cryptocurrency and institutional investors together in a highly liquefied, worldwide market, security tokens could bring the major shift in the world of asset and token exchange.

Challenges with the traditional approach

It needs an epic investment to earn money in security token exchanges. You can earn good amount if you also start with the little with patience. But complexity and low ROI will make think twice for the investors to enter in the market.

Though some trading applications such as eToro have made it effortless for unfamiliar investors to enter the market, you never own the crucial asset as well as trading will be expensive with spreads. Just like that if you need to invest in any property via a crowd funding website, your investment is tied up in a market. So whether its CFDs or crowd funding, it will not be the perfect option to traditional trading.

You might not have enough fund to purchase a share as per the size and type of asset you want to invest. You also need to spend for brokers or funding managers to buy or sell an illiquid yet desirable asset like fine art.

How security tokens aid to come across every problems?

When you tokenize a real-world asset it will be very easy to match buyers and sellers. We can say that better liquidity means less costs. Increased liquidity also makes it easy for low-budget investors to get involved with the security token exchanges that would have been out of reach for them.

The fractionalization of assets generates new opportunities for secure investments. If you have an interest in a property portfolio, via security tokens, buy stakes in properties and spread risk across all the assets you have invested.

Security tokens leave regulatory compliance to the leading-edge blockchain technology and not to people. Each single transaction gets verified on a digital ledger. So it increases the trust factor and no occurrence of human errors.

Security token exchange enables only accredited Investors as they have a superior prominence under financial regulation laws. STOs are the next-generation platforms that deliver trust with crypto trading and deliver more power to today’s crypto-economy.

Importance of STO exchange

Nowadays there are plenty of projects are making it simple to produce, trade and invest in security tokens that signify real-world assets. Some are scheduling the sale of their own security tokens backed by the real estate and loans portfolio.

On 17th July 2018, Coindesk stated that Coinbase, the world’s leading crypto exchange, was permitted to list security tokens on its trading platform. Even Nasdaq has specified that they are all set to the concept of integrating blockchain into the listing of public corporations.

Espay is also helping token based economy by delivering cutting-edge security token exchange solutions. We believe that the users will be able to trade security tokens on our exchange software once the regulatory precipitation has boosted and they have established institutional as well as public support.

Security tokens are still in their initial stage but definitely, they will bring a transformation in a fintech industry. Basic from initiating the global liquidity pools to serving new investors, security tokens could be the next revolution in the capital market.

STOs will be the Future

Security tokens are predicted to have an optimistic future due to the following reasons:

- Extremely Secure: Each security exchange comprises different separated layers of servers, encrypted accessibility to users, DDoS and X-XSS protection, two-factors authentications, HTTP public key as well as protection of Content Security Policy (CSP).

- 9% Uptime: Security exchanges will keep running without any failure, due to its inbuilt features.

- Customizable Exchange Platform: A customizable exchange platform enables users to develop their security token exchange that ensures the liquidity of the exchange into the network.

- Compliant with SEC regulations: Possessing such a license enables security token issuers (security token ICOs) to act under relevant regulations. Espay offers a federally-regulated platform for trading security tokens.

- Tokens backed by real asset/value: A robust asset-backed token exchange with a real-life value that offers actively managed crypto funds and real-world assets.

- Accredited investors: Security token exchanges enable only accredited investors as they have a superior prominence under financial regulation laws.

Source: https://bit.ly/2E0tbAm